Navigating the De Minimis Crisis

Designing a real-time duty calculator to eliminate shipping delays and tax uncertainty

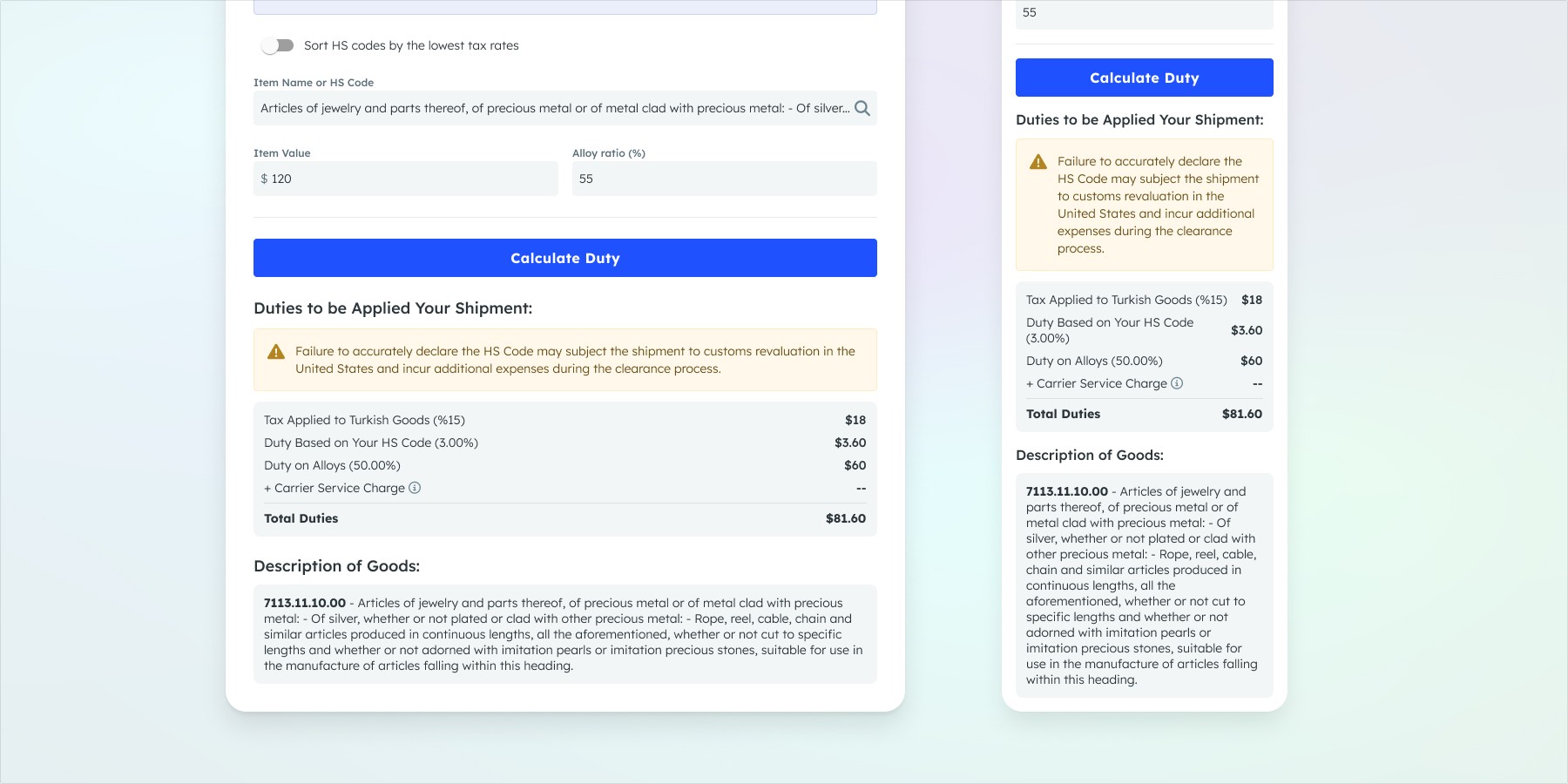

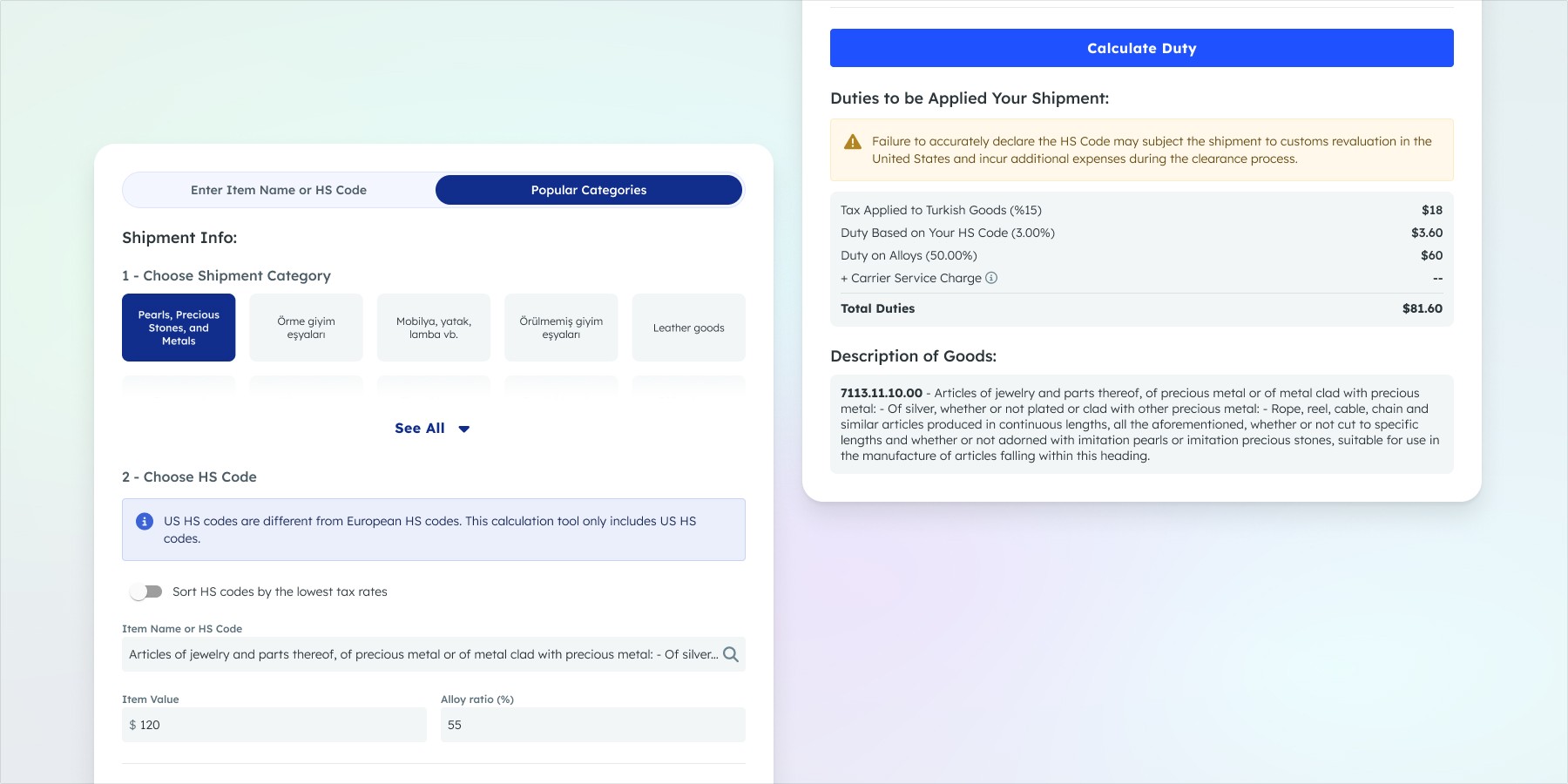

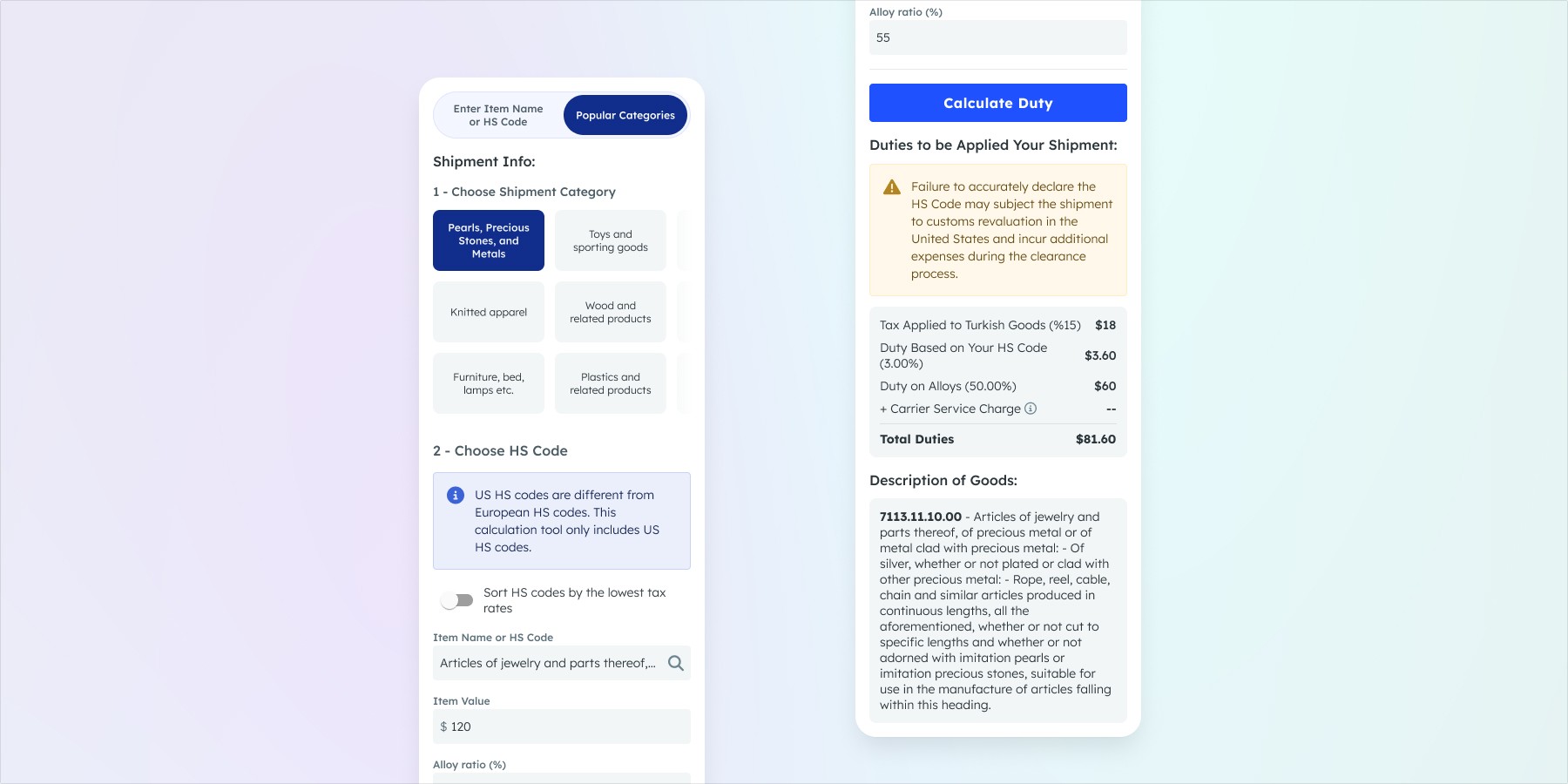

Bridging the Logic Gap

The design required deep-diving into customs data to ensure the "Smart Translation" was foolproof. I focused on:

Simplifying Complexity: Mapping thousands of product categories into a user-friendly search and validation flow.

Reducing Cognitive Load: Designing an interface that required minimal data entry (Code + Price) to deliver a high-stakes financial output.

Carrier Integration Readiness: Ensuring the data output followed the formats required by major shipping carriers who had not yet updated their own systems.

Confidence in Every Shipment

By automating the intersection of logistics and law, the project achieved:

Regulatory Compliance: Eliminated the risk of packages being flagged or returned due to incorrect HS labeling.

Financial Predictability: Empowered sellers to protect their margins by knowing exact tax liabilities before the package left their hands.

Accessibility: Turned a complex customs process into a self-service tool that doesn't require "expert" knowledge to navigate.

Other projects

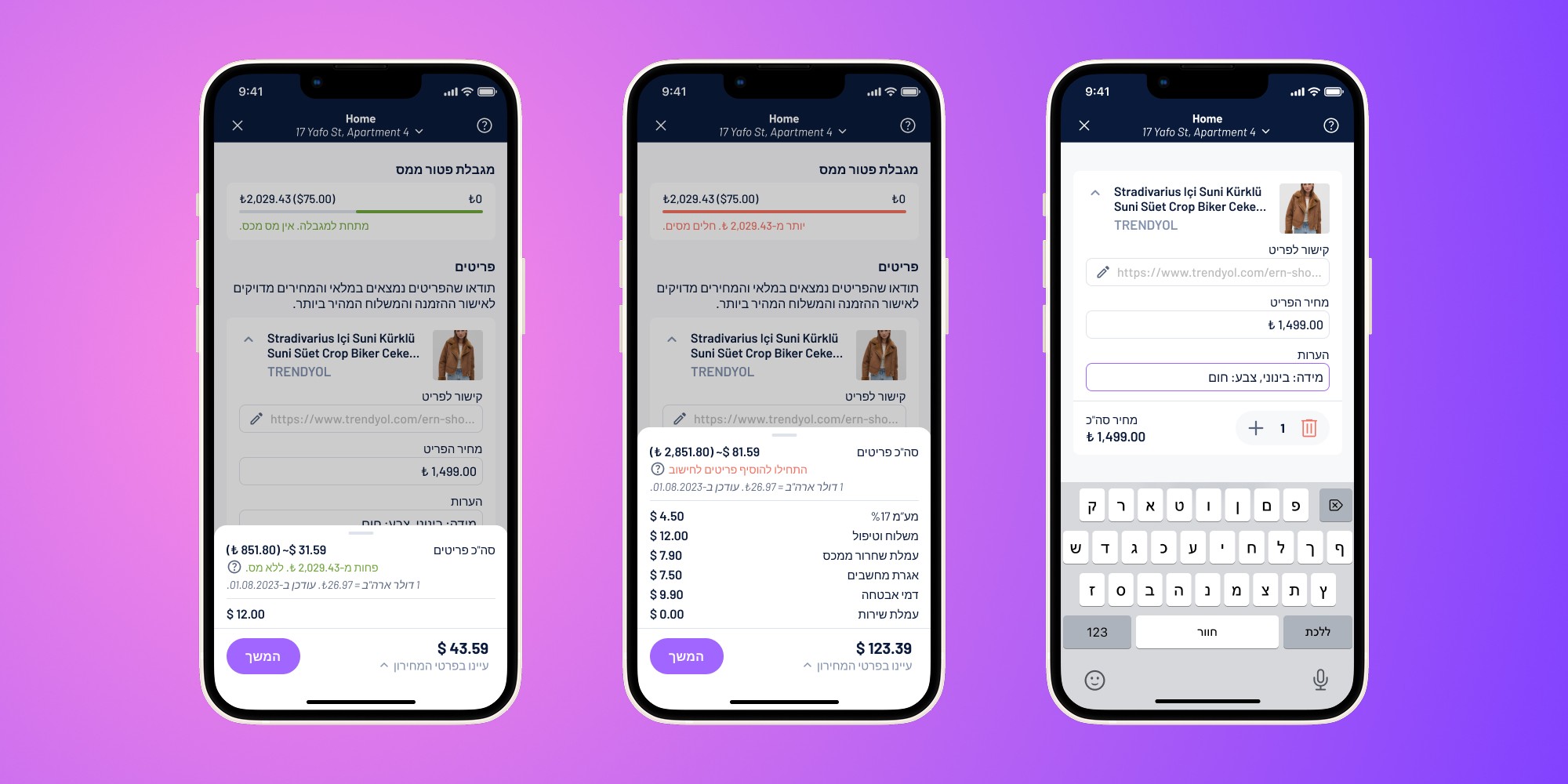

Global Shopping, Local Prices: The "Buy For Me" Experience

An automated personal shopping platform designed to bypass international price discrepancies and maximize tax-free savings

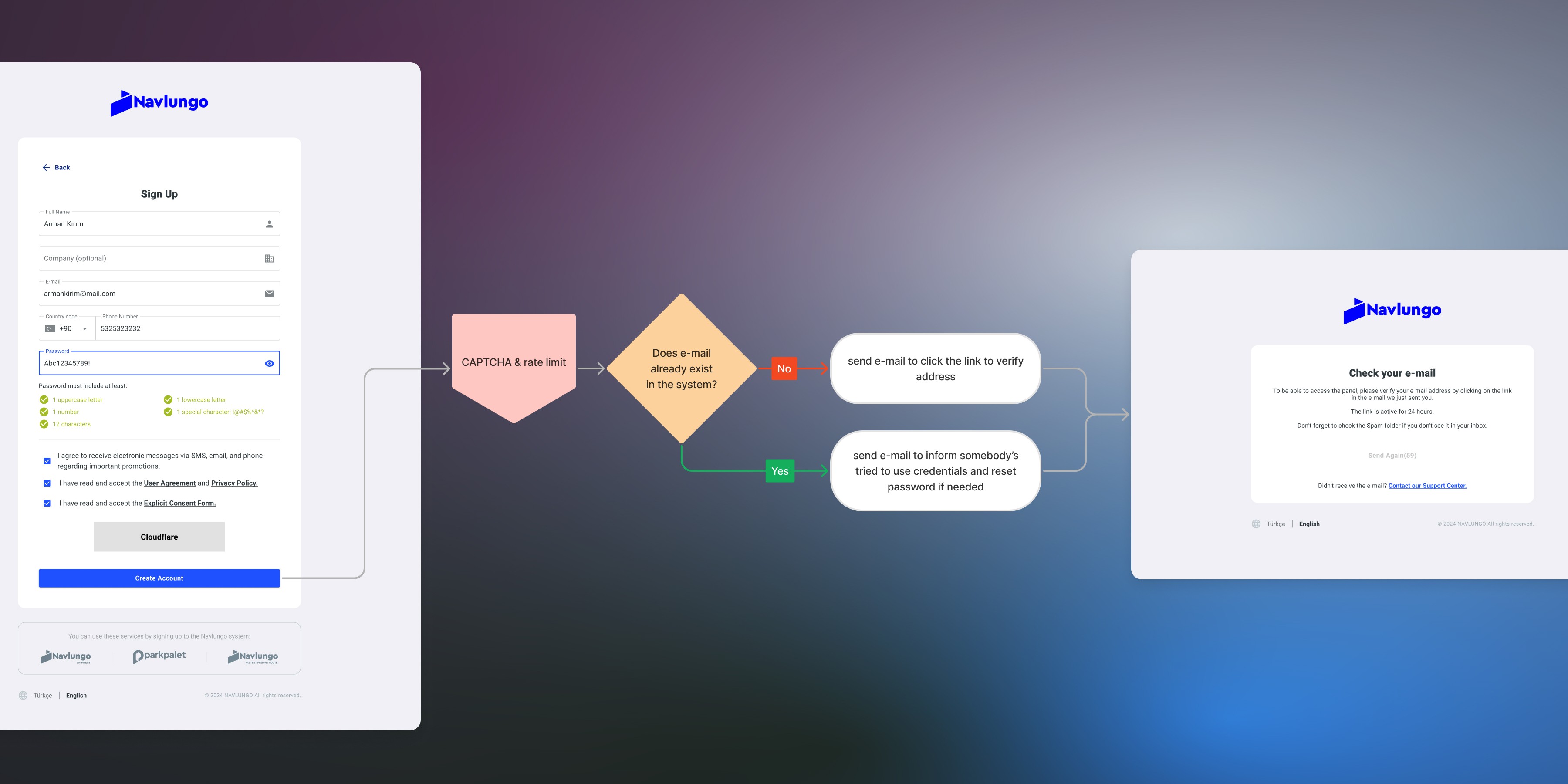

Security by Design: Balancing UX with System Integrity

Securing user data and preventing financial loss through "Intentional Friction"

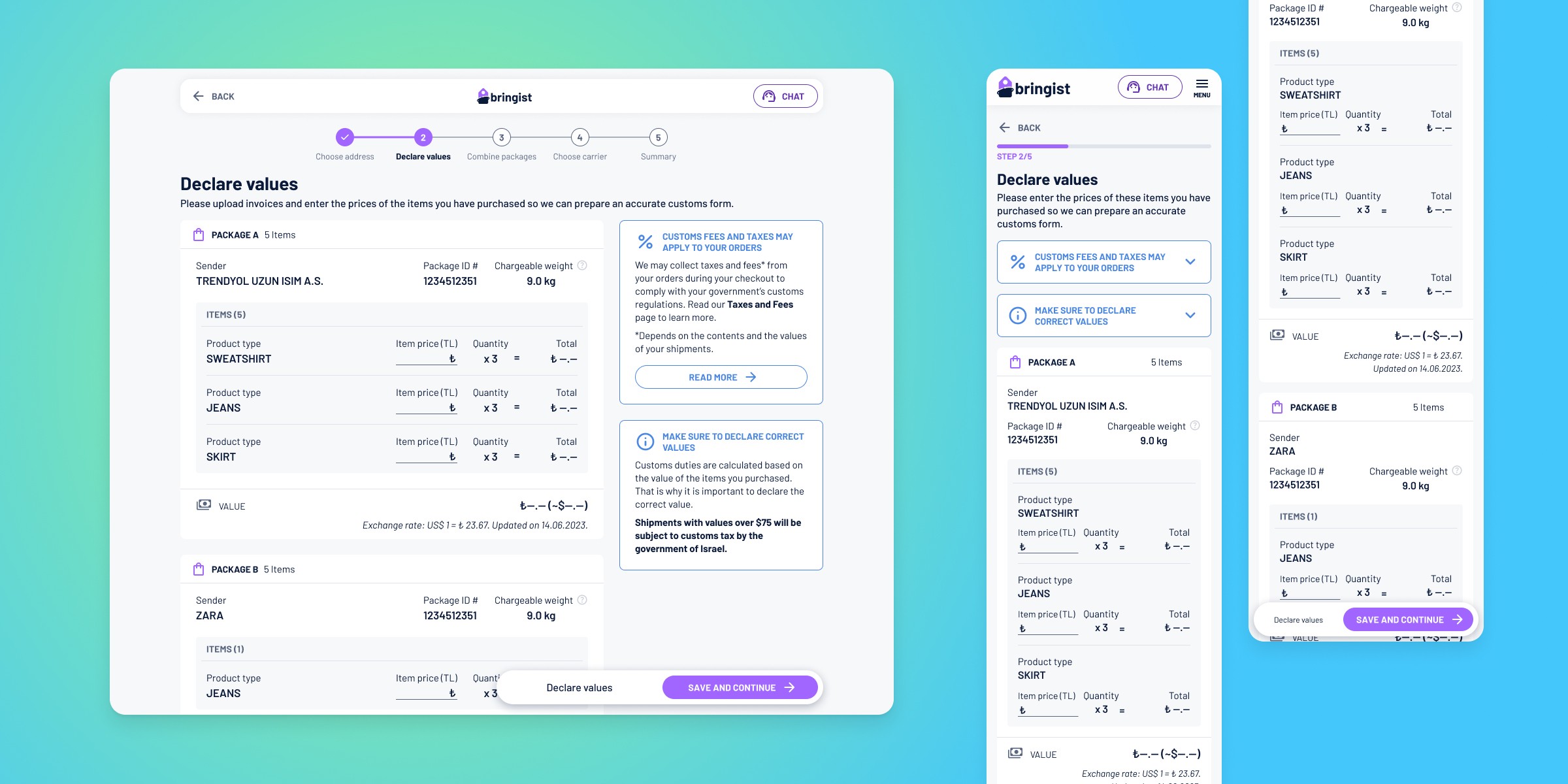

Bringist Panel: Optimizing Global Shipping Costs by Consolidating Packages

Maximizing international savings through virtual PO boxes and package consolidation